Over the past 20 years, notwithstanding some setbacks, Hungary has increasingly developed legal structures and tax structures that provide the requisite measure of legal certainty to foreign investors and companies, permitting them to establish business operations in Hungary with confidence, while actively participating in and contributing to prospering economic development.

Anyone taking a closer look at Hungary is assured of finding an attractive, entrepreneurial basis, well-trained employees who are willing to learn and increasing legal certainty, which provides the confidence needed for long-term planning.

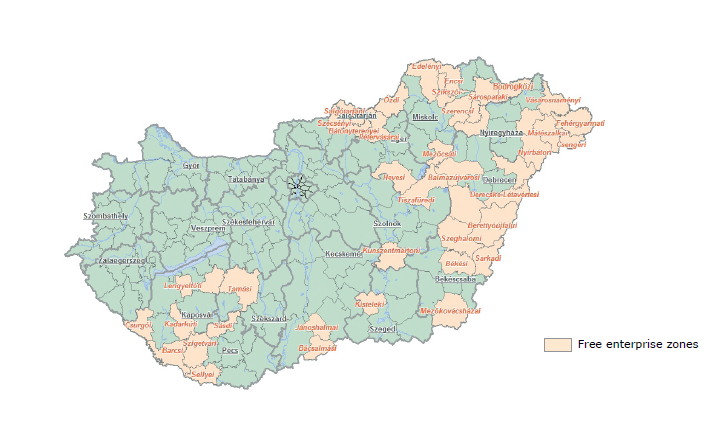

Free Enterprise Zones

From 2013, the state is hoping to boost the economy of 47 regions, primarily located in Eastern Hungary, through the establishment of free enterprise zones. Businesses are offered several types of incentives in these largely disadvantaged areas with significant unemployment, in order for them to carry out as many new manufacturing investments as possible and to increase the level of employment. Such incentives include the following:

- for investments of at least HUF 100 million (approx. EUR 350,000), businesses are entitled to a 80% tax incentive for five years after putting the project into operation;

- for new hires, employers are required to pay only a part of employers’ public contributions (amounting to 28.5% of the gross salary);

- in addition to numerous other types of subsidies, employers are eligible for a subsidy of HUF 400,000 (approx. EUR 1,350) for each new employee hired.

Free entreprise zones in Hungary

Industrial Parks in Hungary

Industrial parks have existed in Hungary for over ten years and have become an integral component of the country’s economic processes. There are 210 industrial parks in Hungary, hosting some 4,200 companies, which employ over 200,000 people. These companies account for 30% of industrial output, making their economic and infrastructural stability and expansion a cornerstone of the development of Hungarian industry.

Spin-Offs and Start-up Businesses

The establishment of technology- and knowledge-intensive start-up businesses has become increasingly more significant in Hungary since the start of the twenty-first century. More and more researchers and students at universities and research institutions began working on the practical implementation of some aspect of their research area and on bringing that to market. Since the mid-2000s, several large tender announcements have been issued, each providing up to EUR 5 to 10 million in support for joint research projects involving universities and industry. Smaller tenders, providing under EUR 1 million in resources for supporting research, development and innovation, have also become regular. With the launch of the Jeremie program, a total of EUR 300 million was invested and is being invested by venture capital investors in spin-off and start-up businesses promising growth.

Subsidies

In the EU’s 2014-2020 budget cycle, a total of EUR 25 billion has been allocated for Hungary, approximately 60 percent of which can be used directly for economic development, primarily through the Economic Development and Innovation Operational Programme (GINOP). In addition, corporations implementing large-scale investments and creating a sufficiently high number of jobs can also be eligible for aids financed from domestic sources, decided individually by the Hungarian Government (EKD).

Small and medium-sized enterprises (SMEs) with a staff of up to 250 are set to be the primary beneficiaries of EU-funded, partially non-refundable grants, except in areas (e.g., innovation, logistics) where large corporations are also likely to receive funding. Cash grants that can be awarded individually by government decision and the often associated corporate tax allowance can be seen as an advantage mostly by well-capitalised corporations.

An important rule for all investors is that the intensity of the so-called regional investment aid available for investment may not exceed the statutory limit. The figure below indicates the maximum aid intensities available for corporations in each region within Hungary:

Data presented in the figure are increased by 20 percentage points for micro and small enterprises, and by 10 percentage points for medium-sized enterprises. For instance, a large enterprise investing in South Transdanubia can be eligible for a maximum aid of 50 percent, whereas medium- and small-sized enterprises investing in the same region can be awarded, respectively, aids of 60 and 70 percent.

While in the previous budget cycle, for-profit organisations were typically awarded non-refundable grants, in the 2014-2020 period refundable funds are likely to play an increasingly important role: in addition to subsidised loans and the various guarantee programmes, a growing number of so-called combined schemes can be expected, which contain both refundable and non-refundable aids and can be awarded in the same tender.

As a positive change – and contrary to earlier practices -, effective as of 1 January 2015, enterprises with certified good standing having operated in Hungary for at least one full business year are not required to provide security (e.g. a bank guarantee).

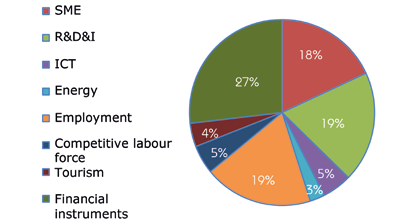

Priority areas of the Economic Development and Innovation Operational Programms

EU funding earmarked for economic development will be available primarily through the Economic Development and Innovation Operational Programme (GINOP). With an overall budget of EUR 7.7 billion for a period of 7 years, the GINOP is principally intended to boost competitiveness through the development of small and medium-sized enterprises (particularly in the processing industry), improve employment and ensure continuous employee development in the following target areas:

Source: MAPI